What If You Die Without a Will

Jan 16, 2024 By Susan Kelly

Advertisement

Even if you pass away "intestate," which means without a will, your belongings will still go to your heirs, but it's possible that they won't get them in the way you would have preferred. Because of this, if you die without a will, the courts will determine who will inherit your property and how much each of your heirs would get. Nevertheless, drafting a will may be difficult at times.

How Your Beneficiaries Are Protected by a Will

Somita Basu, a lawyer at Norton Basu, said that a will identifies the beneficiaries who will inherit your estate and who will administer and distribute your assets when you pass away. Beneficiaries have the legal right to inherit your possessions and are also referred to as heirs-at-law.

If you do not leave a will directing how your assets are to be divided to beneficiaries, your estate will be subject to the legal procedure known as probate. Basu described the procedure as time-consuming, expensive, and long.

When this occurs, the probate court will designate an administrator or representative to handle your business and financial affairs following your passing. This individual is not the one you choose. The administrator is responsible for gathering the dead person's assets and paying their bills and costs. The residual assets of the estate are then distributed to the beneficiaries by the state's laws, which is sometimes time-consuming since the probate court monitors it.

The eventual effect will be that the beneficiaries of your assets will be those identified by the court rather than those nominated by you. It's possible, for instance, that a member of your family who isn't a non-relative might inherit your property rather than the non-relative that you would want to have your possessions. According to Franco, if you are a single person who co-owns a firm and passes away without leaving a will, you place your business partner in a precarious position. Your firm share may be given to a successor you did not choose, which could result in legal conflict.

State Intestate Laws Vary

When a person passes away without leaving a will, the laws of each state determine what happens to their assets. Intestate succession rules in each state provide a formula that the courts will often employ to decide how your property should be distributed after death.

For instance, in New York, if you pass away intestate and have a spouse, but no children, then your spouse will receive all of your assets. If you are childless but have children, those children will get your estate. If you pass away without leaving a will and are survived by a spouse and children, your spouse will get the first $50,000 in addition to half of the remainder of your inheritance. Everything else is passed on to your offspring. Depending on the laws of the state in which you live, the following people may be permitted access to your accounts and assets:

- Stepchildren

- Parents

- Siblings

- Nieces and nephews

- Cousins

- Grandparents

People Who Are Not Married and Who Die Without Wills

Putting out a will or other kind of estate plan may be of utmost significance if you are a single parent. Should you die away without leaving a will, the law will determine who will be responsible for the upbringing of your children, not your wishes, beliefs, or connections with others involved. Without a will, a judge in the probate court will determine things like who will take care of your children and pets, who will receive your money, and who will handle your business operations.

Even if the beneficiary is not linked to the account holder, they are still eligible to receive money from the account once the bank has received verification of the account holder's passing, provided they are named as the beneficiary on the account. The establishment of a trust, which contains such accounts, may assist in the preservation of assets, the reduction of tax concerns, and the prevention of your heirs from frittering away their inheritance.

What Happens If One Spouse Passes Away Without a Will?

What happens when one spouse passes away without leaving a will might depend not only on the rules of the state where they lived but also on whether or not they had children together. For instance, if you pass away without leaving a will and have children in California, the law states that your spouse will receive one-half of your common property and anywhere from one-half to one-third of your separate property. Your spouse will be the only beneficiary of your inheritance if you do not leave behind any children or parents who are still alive. Other governments may have a different methods of asset distribution.

Advertisement

-

Know-how Feb 06, 2024

Know-how Feb 06, 2024Sears Home Warranty Review 2022 in Detail

Compared to other home warranty providers, Sears Home Warranty's 180-day warranty on approved repairs is quite lengthy. While three service plans are available nationwide (except in Alaska and Hawaii), the cost of optional upgrades is high. The whole contiguous United States other than Alaska and Puerto Rico are included in the coverage area.

-

Know-how Jan 23, 2024

Know-how Jan 23, 2024Setting Up Effective Bequests: A Guide to Establishing Your Legacy

Discover the importance of bequests in estate planning. Learn about different types of bequests and how to set one up to ensure your legacy lives on.

-

Know-how Oct 27, 2023

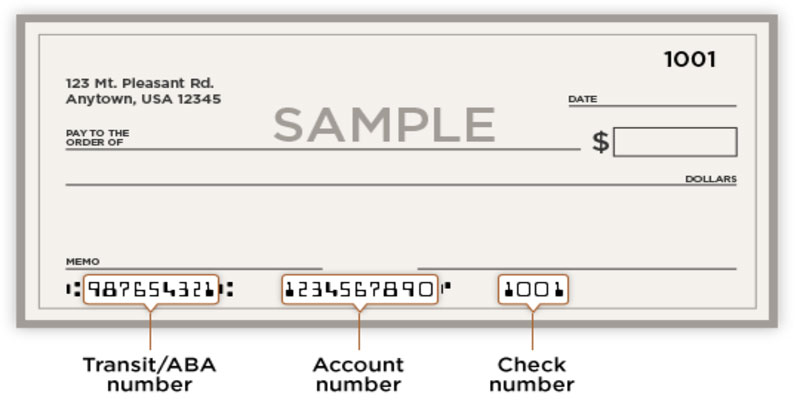

Know-how Oct 27, 2023How Does Check Number Work?

Where can I get the check numbers? There are three sets of numbers at the bottom of a check. The first set identifies your bank's routing information, the second your account information, as well as the third your check number. Knowing where to look for these numbers when filling out documents related to activities like direct deposit or setting up automated payments for monthly bills is helpful.

-

Mortgages Dec 10, 2023

Mortgages Dec 10, 2023Root Causes of the Crisis in Student Loan Debt

The current dilemma in the United States about the burden of student loan debt has been caused by several causes, the most significant of which is the upward trend in the cost of tuition