Advertisement

Advertisement

-

Know-how

Know-howWhat is a Condominium?

A condominium may offer a more affordable entry into the housing market. However, misconceptions concerning condo ownership frequently prevent prospective buyers from considering them. This article will study some of the most widespread money misconceptions about condos.

Feb 13, 2024 -

Know-how

Know-howSears Home Warranty Review 2022 in Detail

Compared to other home warranty providers, Sears Home Warranty's 180-day warranty on approved repairs is quite lengthy. While three service plans are available nationwide (except in Alaska and Hawaii), the cost of optional upgrades is high. The whole contiguous United States other than Alaska and Puerto Rico are included in the coverage area.

Feb 06, 2024 -

Know-how

Know-howEverything You Need To Know About Rental Car Insurance

At the airport rental vehicle counter, where you are standing, the salesperson asks you the dreaded question regarding the insurance coverages available

Jan 24, 2024 -

Know-how

Know-howHow To Acquire A Copy Of Your Driving History

You will need to contact your state's Department of Motor Vehicles (DMV) or a similar agency to obtain a copy of your driving record. You can request a copy online, by mail, or in person. You may be required to provide personal information, such as your name, date of birth, and driver's license number. There may also be a fee for obtaining a copy of your driving record. It is essential to keep a copy of your driving record for your records, as it can be helpful for various purposes, such as applying for car insurance or a job that requires you to drive.

Jan 23, 2024 -

Know-how

Know-howSetting Up Effective Bequests: A Guide to Establishing Your Legacy

Discover the importance of bequests in estate planning. Learn about different types of bequests and how to set one up to ensure your legacy lives on.

Jan 23, 2024 -

Know-how

Know-howEmployee-Owned Companies

ESOP gives employees an ownership interest in the company they work for. Publix Super Markets is the largest employee-owned business in America, with over 200,000 employees.

Jan 18, 2024 -

Know-how

Know-howWhat If You Die Without a Will

Having a will ensures that assets are distributed as per your wishes when you pass away. And if you do not leave a will, the law and a judge determine who gets your property and possessions

Jan 16, 2024 -

Know-how

Know-howAn Analysis of F and G's Life Insurance

FGL Holdings is a family of companies that has been serving the insurance and retirement needs of its customers through the growing independent agency sector for nearly 60 years. Policyholder financial security is a top priority for the F and G Group of Companies (FGL Holdings). Among the several annuity plans available from Fidelity and Guaranty, the Fixed Indexed Annuities stand out as particularly advantageous.

Jan 13, 2024 -

Know-how

Know-howWhat Are NPOs? Examples of Nonprofit Organizations and Their Working

A Nonprofit Organization (NPO) is a business structure organized to serve a public or charitable purpose rather than to make a profit. Click to learn more.

Jan 05, 2024 -

Mortgages

MortgagesAdvantage Education Loan

Fixed-rate Advantage Education Loans are available via the Kentucky Higher Education Student Loan Corp., a nonprofit organization.

Dec 11, 2023 -

Mortgages

MortgagesRoot Causes of the Crisis in Student Loan Debt

The current dilemma in the United States about the burden of student loan debt has been caused by several causes, the most significant of which is the upward trend in the cost of tuition

Dec 10, 2023 -

Know-how

Know-howGrowth of GDP and Its Effect on Recession and Economy

A good American gross domestic product growth is good for the economy, but what happens when the GDP is negative? Learn about how GDP and recession relate to each other in this article.

Dec 04, 2023 -

Know-how

Know-howStrategies to Reduce Bad Debt: A Comprehensive Guide

This document outlines crucial strategies for businesses to reduce bad debt. It highlights the importance of establishing concise payment terms, structuring discount policies, outlining consequences for late payments, and providing detailed invoices.

Dec 01, 2023 -

Know-how

Know-howUnderstanding Amortization vs. Depreciation: How They Work

Confused about amortization and depreciation? This article simplifies these concepts, breaking down their differences and how they function in everyday terms.

Nov 27, 2023 -

Know-how

Know-howThings to Learn About Annual Interest Returns - a Simple Guide

Unlock the secrets of Annual Interest Returns with our simple guide! Learn how to make your money work for you and navigate the world of finance confidently.

Nov 22, 2023 -

Know-how

Know-howHow to Determine (and Correct) Extra IRA Contributions

Although it would be great if you could put all your money into a Roth (think growth and withdrawals tax-free), the IRS has set yearly contribution caps. You must be qualified to donate based on your pay. If you are eligible, there are limitations on how much you can contribute. Traditional IRA contributions are subject to similar limitations. Although you can deduct contributions from your taxes, these IRAs have income restrictions.

Nov 18, 2023 -

Know-how

Know-howTop 4 Best Medicare Supplement Plan G Providers

The most comprehensive coverage for Medicare recipients is now provided by Medicare Supplement Plan G, as Medicare Supplement Plan F is no longer accessible to new beneficiaries. The option of Medigap, commonly known as Medicare Supplement Insurance, is available to persons with Original Medicare who want to reduce out-of-pocket expenses.

Nov 10, 2023 -

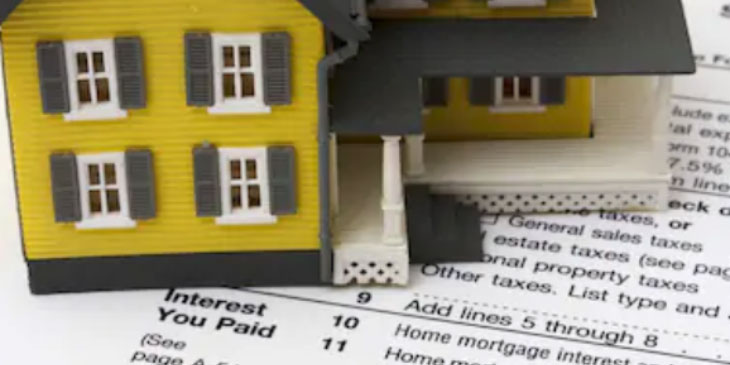

Mortgages

MortgagesWays To Save Money When Filling Mortgage Taxes

The tax deduction for mortgage interest is one of the aspects of homeownership that is likely to be misunderstood the most. It has reached the level of a near-myth. As a result, many people considering buying a property are convinced of its advantages even before they do the necessary calculations to establish whether they are eligible

Nov 09, 2023 -

Know-how

Know-howConstructing a Budget for Your Household Easy Step-By-Step Budgeting

Keeping a house running is no simple task, and it becomes much more challenging when money is tight. That's why making a family budget could be a good idea. Spending a few hours upfront on a budget and savings plan might pay out in spades later on, both financially and emotionally

Nov 01, 2023 -

Know-how

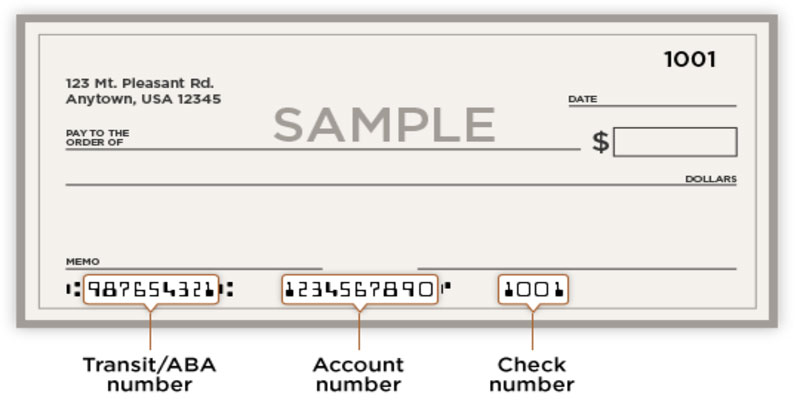

Know-howHow Does Check Number Work?

Where can I get the check numbers? There are three sets of numbers at the bottom of a check. The first set identifies your bank's routing information, the second your account information, as well as the third your check number. Knowing where to look for these numbers when filling out documents related to activities like direct deposit or setting up automated payments for monthly bills is helpful.

Oct 27, 2023 -

Know-how

Know-howReview Of Pemco Insurance Company

Auto, boat, umbrella, and Pemco house insurance coverage are the company's mainstays. For drivers with a spotless record, Pemco Insurance offers competitive rates, but those with a more complicated driving history may pay more. Our vehicle insurance quotation with Pemco for something like a single male driver, age 30, in Seattle came back at $90.68 per month. Only residents of Oregon and Washington may purchase Pemco Insurance.

Oct 20, 2023