Top 4 Best Medicare Supplement Plan G Providers

Nov 10, 2023 By Susan Kelly

Introduction

Best Medicare Supplement Plan G Providers is the supplement plan since it gives beneficiaries of Medicare and the elderly the broadest range of protections. Besides the Part B deductible, Plan G will cover almost all medical costs. This indicates that before your insurance would begin covering any medical costs in 2022, you would need to pay the entire $233 Medicare Part B deductible. The Medicare Supplement Plan G is the undisputed leader in new enrollees. However, the average monthly cost is over $190, so it is not a cheap option. Therefore, when determining whether or not to pay this monthly fee, you should consider your yearly medical expenses.

Original Medicare does not cover all medical costs. There are Medicare Supplement Plans or Medigap to fill the coverage gaps. Medicare Supplement Plan G offers the most comprehensive coverage options, especially for new Medicare enrollees. Medicare Supplement G plans provide the lowest out-of-pocket expenses compared to Medicare Supplement F plans because they cover everything F plans do except the Part B deductible ($203 in 2021).

Humana

Humana's Medicare Plan G, both the standard and high-deductible options, provides its members with several valuable extras. The standard plan has monthly payments based on factors, including coverage area and plan type. The premium for the high deductible plan is lower overall, but you'll have to shell out more money before your insurance kicks in. SilverSneakers members get discounts on eyeglasses and prescription drugs in addition to 24/7 access to a nurse helpline.

More than one company in your state may offer Medicare supplement insurance. Humana's SilverSneakers fitness program and 24-hour nurse phone line are two examples of how it sets itself apart from the competition and makes it easier to understand the subtleties of transplant care and make educated decisions. Another perk is a wellness rewards program called Go365, which gives you points for getting a flu vaccination or attending an exercise class.

AARP

AARP offers the most valuable service for a cost comparison. After entering your ZIP code, you will be directed to a page listing all the plans in your area. Without re-entering your data, you can compare Medicare Advantage, and other Medicare Supplement plans like Plan G and Part D. You can comprehend Medicare's several components and select the plans that best meet your demands with the assistance of AARP. AARP does offer insurance products through UnitedHealth Group, even though it does not offer insurance on its own.

Cigna

Cigna has an A rating from AM Best, similar to UHC and Aetna, indicating that the company has the resources to continue paying medical insurance claims in the future. Cigna's plans are easily available, and its high-deductible A particularly cost-effective strategy to protect against the high expenses of unanticipated medical care is Plan F. The cost of Cigna's Medicare Supplement plans tends to be higher when compared to those of other suppliers. However, you might be able to save money thanks to Cigna's home premium discount. In most states, a household discount is provided when multiple members of the same household enroll in the same Cigna Medigap plan.

Aetna

Aetna is yet another elite Medicare Supplement insurance provider (A rating from AM Best). The premiums for Aetna's Medicare Supplement plans are up to 26% less expensive than those of significant rivals like AARP. Aetna's Medicare Supplement program has received about 57% more complaints than one would anticipate from a business of its size. Thus, fewer plans are available, and clients seeking a Medicare Supplement Plan C, D, K, L, or M must look elsewhere.

The Price of Medigap Insurance

Medicare supplement plans' cost varies depending on the provider and beneficiary choice. It's crucial to remember that not all providers have access to all. The insurers providing the Medigap coverage set the premiums. Businesses choose premium pricing using one of three methods. Each community member pays the same premium rate. Younger people (referred to as the "issue" or "entry" age) who purchase insurance often pay cheaper insurance premiums. The number of years does not result in a rise in rates. When you obtain coverage, costs are calculated based on your age (or your "attained age"). As you get older, your insurance will cost more.

Conclusion

While the 47 states' standards for Medicare supplement plans' coverage are consistent, each insurance company's cost and level of service can vary significantly. Make sure you research the Plan G service providers in your area to obtain the greatest deal and service.

-

Know-how Jan 23, 2024

Know-how Jan 23, 2024How To Acquire A Copy Of Your Driving History

You will need to contact your state's Department of Motor Vehicles (DMV) or a similar agency to obtain a copy of your driving record. You can request a copy online, by mail, or in person. You may be required to provide personal information, such as your name, date of birth, and driver's license number. There may also be a fee for obtaining a copy of your driving record. It is essential to keep a copy of your driving record for your records, as it can be helpful for various purposes, such as applying for car insurance or a job that requires you to drive.

-

Know-how Jan 24, 2024

Know-how Jan 24, 2024Everything You Need To Know About Rental Car Insurance

At the airport rental vehicle counter, where you are standing, the salesperson asks you the dreaded question regarding the insurance coverages available

-

Know-how Oct 27, 2023

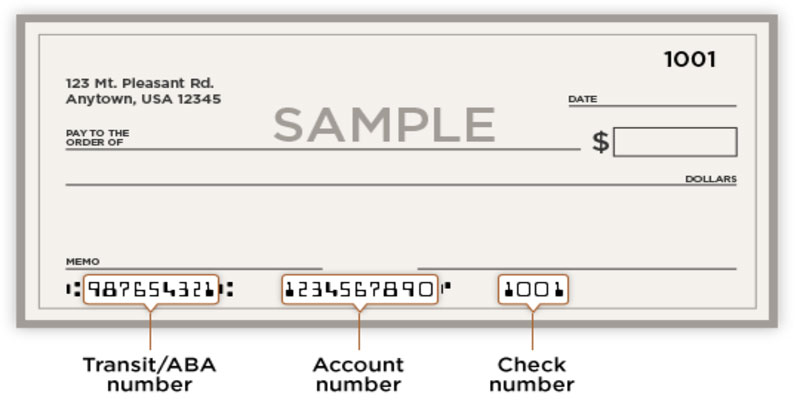

Know-how Oct 27, 2023How Does Check Number Work?

Where can I get the check numbers? There are three sets of numbers at the bottom of a check. The first set identifies your bank's routing information, the second your account information, as well as the third your check number. Knowing where to look for these numbers when filling out documents related to activities like direct deposit or setting up automated payments for monthly bills is helpful.

-

Currency Oct 20, 2024

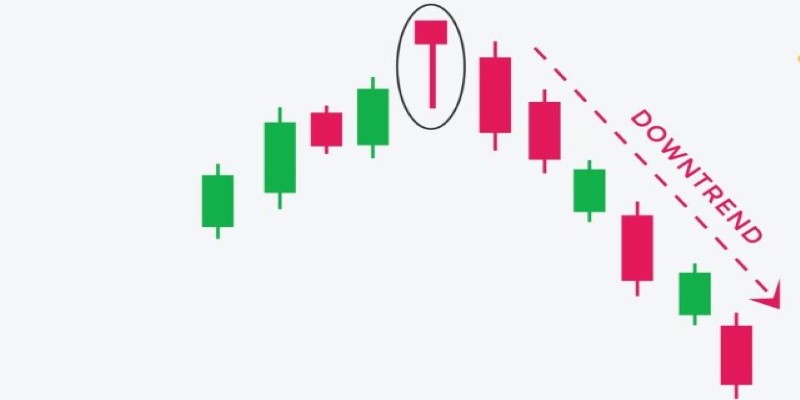

Currency Oct 20, 2024Is the Bull Run Over? Understanding the Hanging Man Candlestick

The Hanging Man Candlestick Pattern is a key tool for traders, offering early signals of a potential trend shift from bullish to bearish. Learn how to effectively spot this pattern, understand its implications, and incorporate it into your technical analysis toolkit