Is the Bull Run Over? Understanding the Hanging Man Candlestick

Oct 20, 2024 By Susan Kelly

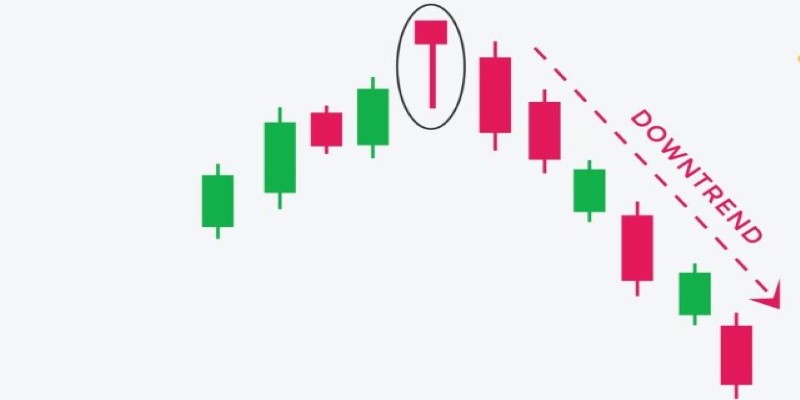

The world of trading is filled with visual patterns that help predict market behavior, and the Hanging Man candlestick is one such tool. Often regarded as a bearish reversal pattern, the Hanging Man signals a potential shift in momentum during an uptrend. But what exactly does this pattern tell traders, and how should you use it effectively?

In this article, well delve into the key aspects of the Hanging Man candlestick pattern, exploring how to identify it, understand its psychology, and apply it in your trading strategies.

What Is the Hanging Man Candlestick Pattern?

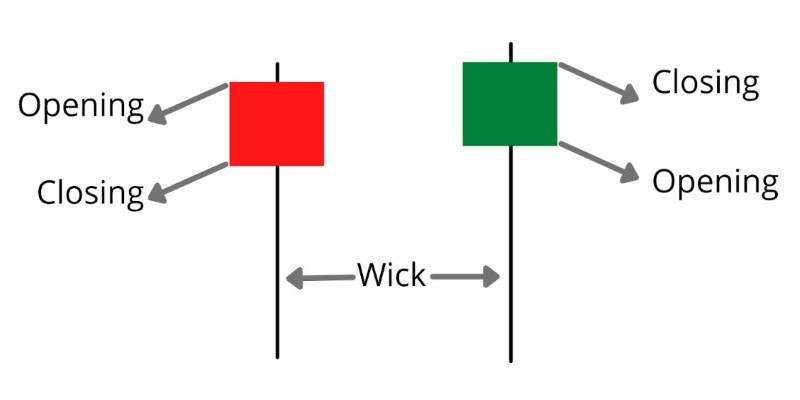

The Hanging Man is a single candlestick pattern that typically appears at the end of an upward trend. The candle itself is characterized by a small real body near the top of its trading range and a long lower shadow, which signifies that the price dropped significantly during the session but later recovered to close near its opening price.

The shape of the Hanging Man is what gives it its namevisually, it resembles a person hanging from a rope. Although this image may seem ominous, it appropriately symbolizes potential trouble for the current bullish trend. The pattern suggests that selling pressure is increasing, and even though buyers managed to regain control by closing, the upward momentum might falter.

How to Recognize a Hanging Man Candlestick?

A Hanging Man candlestick is relatively simple to identify once you know what to look for. Here are the key elements:

Small Body: The candlestick has a small real body, indicating that the opening and closing prices are close to each other.

Long Lower Shadow: The shadow (or wick) extending below the body is at least twice the length of the body, reflecting a significant drop in price during the session.

Little to No Upper Shadow: There is often no upper shadow, but if present, it is short.

Preceding Uptrend: Importantly, this pattern forms after a consistent upward trend, making it a potential sign that the bullish move is losing steam.

The Hanging Man is primarily a warning sign, and its true effectiveness comes when it is followed by a confirmation signala downward move in the next trading session.

Trading the Hanging Man Pattern

The Hanging Man candlestick is not a standalone signal; traders usually look for confirmation before making a move. Here's how you can trade based on this pattern:

Wait for Confirmation

Once you spot a Hanging Man, the next day's price action is crucial. If the next candlestick closes below the Hanging Man's body, it confirms that the bearish sentiment is taking hold, and a reversal might be underway. This confirmation is often referred to as a "bearish engulfing" pattern, signaling traders to consider a short position.

Consider Volume

Volume plays an important role in determining the strength of the Hanging Man pattern. A high-volume session when the Hanging Man forms is more indicative of a significant reversal than one with a lower volume. This is because strong selling pressure, indicated by increased volume, suggests that more traders are speculating on a price decline.

Set a Stop-Loss

Risk management is crucial when trading candlestick patterns. For Hanging Man setups, it is advisable to place a stop-loss order above the high of the Hanging Man candle. If the market continues to climb, this stop-loss will limit your downside.

Use Additional Indicators

While the Hanging Man pattern provides a valuable clue, it's best used in conjunction with other technical indicators. Tools like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can offer further confirmation of overbought conditions, strengthening the case for a bearish reversal.

Benefits and Drawbacks of the Hanging Man Pattern

While it can act as an early signal for a bearish reversal, it's important to understand its strengths and limitations to use it effectively in your trading strategy.

Benefits of the Hanging Man Pattern

Easy to Identify: The Hanging Man is a relatively simple pattern to spot on a candlestick chart. Its distinct shape, characterized by a small real body and long lower shadow, makes it easily recognizable for traders at all levels.

Early Reversal Signal: One of the key benefits of the Hanging Man is that it can act as an early warning of a potential bearish reversal in an uptrend. This can be valuable for traders looking to exit long positions or initiate short trades before a major downturn occurs.

Helps Confirm Overbought Conditions: The Hanging Man pattern signals a potential end to an uptrend, suggesting an overbought asset. Paired with the Relative Strength Index (RSI), it offers a clearer indication of diminishing momentum.

Drawbacks of the Hanging Man Pattern

Requires Confirmation: One of the biggest drawbacks of the Hanging Man pattern is that it should not be traded on its own without confirmation. A downward move in the following session is necessary to validate the signal. Without this confirmation, the pattern may lead to false assumptions about a reversal.

Can Give False Signals: Like any technical pattern, the Hanging Man is not foolproof. In strong uptrends, it may appear without resulting in any significant price reversal, leading traders to make poor decisions if they act solely based on its appearance.

Short-Term Indicator: The Hanging Man primarily indicates short-term reversals and does not provide long-term guidance. Traders seeking longer-term trends may find this pattern less useful, as it focuses on immediate price movements rather than sustained changes in market direction.

Conclusion

The Hanging Man candlestick pattern is a powerful tool in a trader's arsenal, offering insights into potential reversals in an uptrend. Its appearance signals caution, especially when confirmed by subsequent bearish price action. However, like all technical analysis tools, it should not be used in isolation. Traders should consider volume, broader market conditions, and other technical indicators to strengthen their decision-making.

By understanding the psychology and structure of the Hanging Man pattern, you can add a valuable layer of analysis to your trading strategies, allowing you to anticipate market movements more effectively.

-

Know-how Jan 23, 2024

Know-how Jan 23, 2024Setting Up Effective Bequests: A Guide to Establishing Your Legacy

Discover the importance of bequests in estate planning. Learn about different types of bequests and how to set one up to ensure your legacy lives on.

-

Currency Oct 20, 2024

Currency Oct 20, 2024Is the Bull Run Over? Understanding the Hanging Man Candlestick

The Hanging Man Candlestick Pattern is a key tool for traders, offering early signals of a potential trend shift from bullish to bearish. Learn how to effectively spot this pattern, understand its implications, and incorporate it into your technical analysis toolkit

-

Know-how Nov 27, 2023

Know-how Nov 27, 2023Understanding Amortization vs. Depreciation: How They Work

Confused about amortization and depreciation? This article simplifies these concepts, breaking down their differences and how they function in everyday terms.

-

Know-how Nov 01, 2023

Know-how Nov 01, 2023Constructing a Budget for Your Household Easy Step-By-Step Budgeting

Keeping a house running is no simple task, and it becomes much more challenging when money is tight. That's why making a family budget could be a good idea. Spending a few hours upfront on a budget and savings plan might pay out in spades later on, both financially and emotionally