Setting Up Effective Bequests: A Guide to Establishing Your Legacy

Jan 23, 2024 By Triston Martin

A bequest is a powerful and meaningful way to leave a lasting impact on the causes or individuals you care about. Often associated with wills and estate planning, a bequest allows you to designate a specific gift, whether it be money, property, or other assets, to be given to a person or organization after your passing. By carefully considering your objectives and following a thoughtful process, you can ensure that your bequest reflects your values and priorities throughout your lifetime.

Understanding Bequests:

A bequest is essentially a provision in your will that outlines how you want your assets to be distributed upon your death. This legally binding document ensures that your wishes are carried out and your legacy endures. Bequests can be made to family members, friends, charitable organizations, or any other entity you deem deserving. By identifying your objectives and consulting with professionals, you can create a bequest that aligns with your overall estate plan and meets all legal requirements.

Types of Bequests:

There are several types of bequests, each serving a unique purpose. Let's explore them in more detail:

Specific Bequest:

This involves leaving a specific item or amount of money to a particular individual or organization. You have the freedom to choose the specific gift that holds significance to you and the recipient. It could be a cherished family heirloom, a sum of money to support someone's education, or a valuable asset that you wish to pass on.

Residuary Bequest:

A residuary bequest in your will is like the grand finale, where a percentage or the remainder of your estate takes center stage after specific bequests and debts have had their share. settled. It provides a fair and balanced distribution of remaining assets, ensuring that any unforeseen or unaccounted-for assets are allocated according to your wishes. Including a residuary bequest safeguards your intentions for the future.

Contingent Bequest:

A contingent bequest outlines the conditions under which the gift will be made, typically in the event that the primary beneficiary predeceases you or is unable to receive the bequest. It provides an alternative plan to ensure your intentions are carried out. For example, you may designate a contingent beneficiary who will receive your bequest if the primary beneficiary is unable to fulfill the requirements.

Restricted Bequest:

This specifies how the bequest should be used by the recipient, such as for a particular purpose or project. It allows you to make a lasting impact by directing the use of the gift toward a cause or initiative that resonates with you. Whether it's supporting medical research, funding scholarships, or preserving cultural heritage, a restricted bequest ensures that your philanthropic goals are met.

By understanding these different types of bequests, you can make informed decisions about how you want to leave a lasting legacy and support the causes and people that matter most to you.

Setting Up a Bequest:

Setting up a bequest requires thoughtful consideration and careful planning. By following these key steps, you can ensure that your bequest is well-structured and reflects your wishes:

Identify Your Objectives:

Clearly define your goals and intentions for the bequest. Consider which individuals or organizations you want to support and what specific assets or properties you would like to include in the bequest. This will help you create a bequest that aligns perfectly with your values, passions, and priorities.

Consult with Professionals:

Seek the guidance and expertise of legal and financial professionals, such as an experienced estate planning attorney or a knowledgeable financial advisor. Their valuable insights and advice will ensure that your bequest aligns with your overall estate plan, takes advantage of any tax benefits, and meets all legal requirements.

Draft Your Will:

Collaborate with an attorney to draft or update your will to include the bequest. Work together to ensure that your will provides specific and detailed instructions about the gift, including the recipient's full name, their relationship to you, and any special conditions or restrictions you wish to impose. This level of clarity will help ensure that your intentions are clearly communicated and carried out according to your wishes.

Inform Your Loved Ones:

Openly communicate your intentions to your family members and beneficiaries. By sharing your plans and discussing your bequest with them, you can avoid any confusion or disputes that may arise after your passing. Clear and transparent communication will help prevent misunderstandings and ensure that your wishes are respected and honored.

Periodic Review:

Develop the habit of regularly reviewing and updating your will, particularly after significant life events like marriage or divorce., The arrival of new children or grandchildren, or notable shifts in your financial circumstances. Keeping your bequest aligned with your evolving priorities and circumstances is crucial. Regularly reviewing and updating your estate plan will help ensure that it continues to accurately reflect your values, intentions, and desires over time.

What is the structure of bequest?

The structure of a bequest is unique to each individual and their specific objectives. However, certain key elements are typically included in a well-structured bequest:

- Clearly defined objectives and goals

- Identification of recipients and assets to be included in the bequest

- Consideration of legal and financial implications

- Detailed instructions and conditions for the gift

By following these guidelines, you can create a comprehensive and effective bequest that reflects your values, meets all legal requirements, and ensures

Conclusion:

A bequest is a powerful tool that allows you to leave a lasting impact on the people and causes that matter most to you. By understanding the types of bequests available and following a thoughtful process to set one up, you can ensure that your legacy lives on in a meaningful and purposeful way. Consult with professionals, communicate your intentions, and regularly review your estate plan to ensure that your bequest reflects your values and priorities throughout your lifetime.

-

FinTech Sep 08, 2024

FinTech Sep 08, 2024How Much Budget Should Fintech Companies Allocate for Marketing?

To maximize your operations, allocate 10-15% of your revenue to fintech digital marketing. However, you should also consider your competitors.

-

Know-how Jan 18, 2024

Know-how Jan 18, 2024Employee-Owned Companies

ESOP gives employees an ownership interest in the company they work for. Publix Super Markets is the largest employee-owned business in America, with over 200,000 employees.

-

Know-how Oct 27, 2023

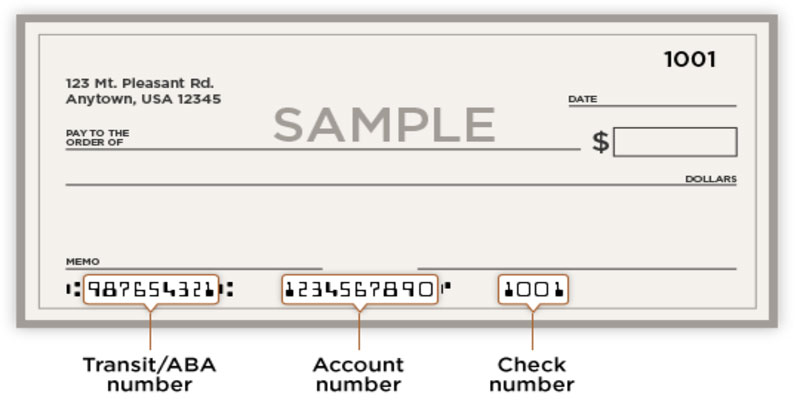

Know-how Oct 27, 2023How Does Check Number Work?

Where can I get the check numbers? There are three sets of numbers at the bottom of a check. The first set identifies your bank's routing information, the second your account information, as well as the third your check number. Knowing where to look for these numbers when filling out documents related to activities like direct deposit or setting up automated payments for monthly bills is helpful.

-

Know-how Jan 13, 2024

Know-how Jan 13, 2024An Analysis of F and G's Life Insurance

FGL Holdings is a family of companies that has been serving the insurance and retirement needs of its customers through the growing independent agency sector for nearly 60 years. Policyholder financial security is a top priority for the F and G Group of Companies (FGL Holdings). Among the several annuity plans available from Fidelity and Guaranty, the Fixed Indexed Annuities stand out as particularly advantageous.